Z MAGAZINE

Capitalism’s Ironic Defenders

Capitalism’s Ironic Defenders

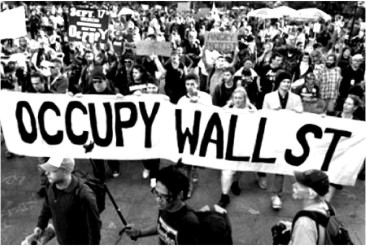

Capitalism finds some of its most under-acknowledged supporters among liberal and progressive commentators who pile ridicule on some of its most egregious offenders atop the financial sector. Look, for one example, at television personality Dylan Ratigan’s book Dirty Bastards: How We Can Stop Corporate Communists, Banksters, and Other Vampires From Sucking Us Dry (2012), a New York Times bestseller. In Dirty Bastards, Ratigan claims that the United States’ current “vampire” economic order is “the opposite of capitalism.” He calls the new order “extractionism”: a system based on “taking money from others without creating anything of value, anything that produces economic growth or improves our lives.” His book is dedicated to exposing the gluttonous Wall Street financial “bastards” who are “tearing down” America because they “take,” like “vampires,” rather than “make” goods, like good capitalists.

Capitalism finds some of its most under-acknowledged supporters among liberal and progressive commentators who pile ridicule on some of its most egregious offenders atop the financial sector. Look, for one example, at television personality Dylan Ratigan’s book Dirty Bastards: How We Can Stop Corporate Communists, Banksters, and Other Vampires From Sucking Us Dry (2012), a New York Times bestseller. In Dirty Bastards, Ratigan claims that the United States’ current “vampire” economic order is “the opposite of capitalism.” He calls the new order “extractionism”: a system based on “taking money from others without creating anything of value, anything that produces economic growth or improves our lives.” His book is dedicated to exposing the gluttonous Wall Street financial “bastards” who are “tearing down” America because they “take,” like “vampires,” rather than “make” goods, like good capitalists.

A similar narrative, more elegantly developed, pervades another New York Times bestseller, progressive journalist Matt Taibbi’s Griftopia: A Story of Bankers, Politicians, and the Most Audacious Power Grab in History (2010). Telling much the same story of parasitic financiers who suck up the nation’s wealth while dismantling its once proud industrial base, Taibbi says that the difference between understanding and misunderstanding Wall Street’s complex financial instruments “is the difference between perceiving how Wall Street made its money in the last decades as normal capitalist business and seeing the truth of what it often was instead, which was simple fraud and crime” (Griftopia 14). By Taibbi’s account: “….the financial leaders of America and their political servants have seemingly reached the cynical conclusion that our society is not worth saving and have taken on a new mission that involves not creating wealth for all, but simply absconding with whatever wealth remains in our hollowed-out economy…. The same giant military-industrial complex that once dotted the American states with smokestacks and telephone poles as far as the eye could see has now been expertly and painstakingly refitted for a monstrous new mission: sucking up whatever savings remains in the pockets of the actual people living between the coasts, the little hidden nest eggs of the men and women who built the country and fought its wars.”

The notion that the destructive, sponging, and crisis-prone behavior of the financial elite and its corruption of political officials mark a ravenous, bloodsucking, and criminal departure from the benevolent and balanced norm of capitalism is common in recent liberal literature on the U.S. economy.

It is present in Nobel laureate economist Joseph Stiglitz’s recent volume The Price of Inequality (New York, 2012), which details how high finance has rigged the American economic and political game in the interest of “rent-taking”—a form of economic activity in which investors receive wealth without contributing to society—and contains the following statement on its back cover: “in recent years well-heeled interests have compounded their wealth by stifling true, dynamic capitalism.” Similar notions can be found (among other places) in the writings of Paul Krugman (another Nobel Prize-winning U.S. liberal-Keyensian economist and public intellectual) and in leading liberal political scientists Jacob Hacker and Paul Pierson’s widely read book, Winner-Take-All Politics: How Washington Made the Rich Richer and Turned its Back on the Middle Class (New York, 2010). The latter volume calls for rolling back the outsized wealth and power of finance capital so as to unleash “vibrant, dynamic capitalism,” which “requires that guidance that only a vibrant, dynamic democracy can provide.”

American economic and political game in the interest of “rent-taking”—a form of economic activity in which investors receive wealth without contributing to society—and contains the following statement on its back cover: “in recent years well-heeled interests have compounded their wealth by stifling true, dynamic capitalism.” Similar notions can be found (among other places) in the writings of Paul Krugman (another Nobel Prize-winning U.S. liberal-Keyensian economist and public intellectual) and in leading liberal political scientists Jacob Hacker and Paul Pierson’s widely read book, Winner-Take-All Politics: How Washington Made the Rich Richer and Turned its Back on the Middle Class (New York, 2010). The latter volume calls for rolling back the outsized wealth and power of finance capital so as to unleash “vibrant, dynamic capitalism,” which “requires that guidance that only a vibrant, dynamic democracy can provide.”

American economic and political game in the interest of “rent-taking”—a form of economic activity in which investors receive wealth without contributing to society—and contains the following statement on its back cover: “in recent years well-heeled interests have compounded their wealth by stifling true, dynamic capitalism.” Similar notions can be found (among other places) in the writings of Paul Krugman (another Nobel Prize-winning U.S. liberal-Keyensian economist and public intellectual) and in leading liberal political scientists Jacob Hacker and Paul Pierson’s widely read book, Winner-Take-All Politics: How Washington Made the Rich Richer and Turned its Back on the Middle Class (New York, 2010). The latter volume calls for rolling back the outsized wealth and power of finance capital so as to unleash “vibrant, dynamic capitalism,” which “requires that guidance that only a vibrant, dynamic democracy can provide.”

American economic and political game in the interest of “rent-taking”—a form of economic activity in which investors receive wealth without contributing to society—and contains the following statement on its back cover: “in recent years well-heeled interests have compounded their wealth by stifling true, dynamic capitalism.” Similar notions can be found (among other places) in the writings of Paul Krugman (another Nobel Prize-winning U.S. liberal-Keyensian economist and public intellectual) and in leading liberal political scientists Jacob Hacker and Paul Pierson’s widely read book, Winner-Take-All Politics: How Washington Made the Rich Richer and Turned its Back on the Middle Class (New York, 2010). The latter volume calls for rolling back the outsized wealth and power of finance capital so as to unleash “vibrant, dynamic capitalism,” which “requires that guidance that only a vibrant, dynamic democracy can provide.”

The assumption of a munificent and sensible capitalist system perverted by the criminal, de-stabilizing parasitism and greed of the financial sector is explicit in Charles Ferguson’s widely read book, Predator Nation: Corporate Criminals, Political Corruption, and the Hijacking of America Predator Nation (2012). That volume’s opening chapter contains a revealing caveat, expressing the author’s underlying allegiance to the profit system: “I should perhaps make one comment about where I’m coming from. I’m not against business, or profits, or becoming wealthy. I have no problem with people becoming billionaires…but that’s not how most of the people mentioned in this book became wealthy. Most of them became wealthy by being well-connected and crooked.”

Predator Nation gives policy recommendations to reign in and regulate the U.S. financial sector. Above all, however, Ferguson seems interested in criminal prosecution of “the bad guys [who] got away with it”—with causing the financial crisis and subsequent epic recession of 2007-2009. Ferguson cites his desire to call those “bad guys” out as the first reason he wrote his book. He decries on the first page that, “As of early 2012 there has still not been a single criminal prosecution of a senior financial executive related to the financial crisis.”

In Business to Make Profits, Period

The problem with these and other analyses in the same vein is not that their descriptions of finance capital’s importance, behavior, and consequences are inaccurate. There has occurred in the neoliberal era (mid-1970s to the present) a significant shift of investors’ domestic preference from industrial production to “FIRE”—finance, insurance, and real estate—a transformation that tripled financial institutions’ share of total U.S. corporate profits (Noam Chomsky, Making the Future).

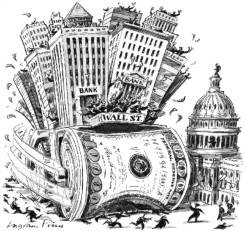

These profits have not contributed to much in the way of national economic development. “For years,” the New Yorker’s perceptive economics writer John Cassidy has noted, “the most profitable industry in America has been one that doesn’t design, build, or sell a single tangible thing.” Economists’ standard argument for such “financial innovations” as asset-backed securities (ABS) and the various derivative financial instruments associated with them like Credit Default Swaps (CDS) and Collateralized Debt Obligations (CDS) has been that they increase the size of the overall economic pie to the “trickle-down” benefit of all. “But these types of things don’t add to the pie,” Cassidy rightly observes, “They redistribute it”—upward (J. Cassidy, “What Good is Wall Street?” the New Yorker, November 29, 2010). They also create remarkable dangers of financial and attendant economic collapse, exacerbated by the requirement that taxpayers spend trillions of dollars bailing out the very financial institutions who developed and marked the “weapons of mass economic destruction” whose implosion sparked the first true crisis of capitalism in its neoliberal phase.

These profits have not contributed to much in the way of national economic development. “For years,” the New Yorker’s perceptive economics writer John Cassidy has noted, “the most profitable industry in America has been one that doesn’t design, build, or sell a single tangible thing.” Economists’ standard argument for such “financial innovations” as asset-backed securities (ABS) and the various derivative financial instruments associated with them like Credit Default Swaps (CDS) and Collateralized Debt Obligations (CDS) has been that they increase the size of the overall economic pie to the “trickle-down” benefit of all. “But these types of things don’t add to the pie,” Cassidy rightly observes, “They redistribute it”—upward (J. Cassidy, “What Good is Wall Street?” the New Yorker, November 29, 2010). They also create remarkable dangers of financial and attendant economic collapse, exacerbated by the requirement that taxpayers spend trillions of dollars bailing out the very financial institutions who developed and marked the “weapons of mass economic destruction” whose implosion sparked the first true crisis of capitalism in its neoliberal phase.

None of this has changed since the epic financial meltdown of 2007-08, reflecting the outsized political influence of Wall Street’s spectacularly rich and powerful chieftains. The big banks and investment houses have avoided serious new regulations, much less criminal investigation and prosecution, much to the (understandable) chagrin of Ratigan, Taibbi, and Ferguson, et al. This is all quite despicable.

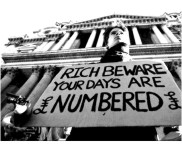

And who in progressive circles wouldn’t enjoy seeing Jamie Dimon and other hyper-opulent Wall Street chiefs hauled off to prison for their dastardly roles in the liquidation of livelihoods and the destruction of families and communities across America—all while lining their own super-opulent pockets in a nation that now ranks 95th in the world in terms of income equality, “just behind Nigeria, Iran, Cameroon, and the Ivory Coast” (Predator Nation)?

Still, writers like Ratigan, Taibbi, and Ferguson do their readers and the cause of progressive change a disservice when they suggest that the exploitative financial behavior they denounce is somehow different from the real or “normal” nature of the capitalist system. “U.S. Steel,” that company’s former Chair David Roderick once candidly commented in explaining why his firm was laying off workers and closing plants, “is in business to make profits, not to make steel” (David Bensman and Roberta Lynch, Rusted Dreams: Hard Times in a Steel Community).

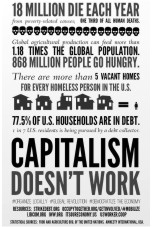

“Rarely is the reality put with greater clarity,” notes the Marxist political scientist David McNally: “under capitalism, use is irrelevant; profit is king. Capitalist enterprises have no particular attachment to what they turn out, be it flat-rolled steel, loaves of bread, or pairs of jeans” (D. McNally: Global Slump: The Economics and Politics of Crisis and Resistance). And, it should be added, capitalism has no intrinsic attachment to making anything material or tangible in any particular country. Purely financial and largely parasitic instruments like junk bonds and CDs and CDOs are normal capitalist productions no less than a ton of steel produced by a multinational corporation in Gary, Indiana—or, for that matter, in central China. When capitalism is understood for what it is really about (investor profit), there is nothing paradoxical about its failure to serve working people or the common good or the economic development, industrial policy, and employment needs of the United States or any other country.

Making Things, Taking Surplus Value

But even when and where the profits system is fulfilling Ratigan’s notion of a good, true, and dynamic capitalism—one that involves “making” tangible goods and manufacturing jobs instead of just rent-taking and speculation inside the United States—it does so in a way that is all about extraction and exploitation. Most of us interact with the so-called free market primarily by renting out our core human capacity for work to more privileged others in order to survive—to purchase use values that make life possible. Capitalists are different, by economic definition. They and (above all) their highly organized concentrations of profit-seeking capital—corporations—care about little beyond exchange value and profit. They engage the market as investors seeking to exploit the world and its people for gain. There would be no capitalist point to their investment without exploitation. There would be no purpose for them in paying us wages and salaries without surplus value—extra labor value going to them beyond the commodity price of our labor power.

There’s a long, ongoing, and frequently bloody history of conflict between capitalists and workers resulting from the struggle between labor and capital over how much surplus value (surplus labor) the latter is entitled to extract from the former in return for making the profit-seeking investments that drive “growth.” A related ugly environmental history reflects merchant and industrial capital’s long history of extracting and exploiting natural resources for profit.

Beyond Greed

Contrary to liberals and progressives who are morally offended (understandably) by the 1% “takers,” it is not simply or even mainly greed that pushes capitalists to engage in this “extractionism.” As McNally explains, industrial capitalists are driven to exploit workers by their own intra-class competition with each other for market share: “….this drive for profit is not a mere personal idiosyncrasy of an individual investor…. Each owner of a bakery, every investor in a garment factory, every CEO of a steel mill is competing with many others. Each is trying to bring to market a product of equal quality at less cost…. And that means profits must regularly be plowed back into the company in order to buy the latest technology, machines, and equipment. Only in this way can the company become more efficient, capable of producing the same goods (or an improved one) more quickly and cheaply. But such improvements are not possible without making profits; they can only be paid for if the company earns more than it spends…competition compels each firm to minimize costs and maximize profits. And because the source of all profit is unpaid work, or as Marx prefers, surplus labor, if profits are to rise then labor must be sped up and intensified, its productivity increased” (McNally, Global Slump).

Contrary to liberals and progressives who are morally offended (understandably) by the 1% “takers,” it is not simply or even mainly greed that pushes capitalists to engage in this “extractionism.” As McNally explains, industrial capitalists are driven to exploit workers by their own intra-class competition with each other for market share: “….this drive for profit is not a mere personal idiosyncrasy of an individual investor…. Each owner of a bakery, every investor in a garment factory, every CEO of a steel mill is competing with many others. Each is trying to bring to market a product of equal quality at less cost…. And that means profits must regularly be plowed back into the company in order to buy the latest technology, machines, and equipment. Only in this way can the company become more efficient, capable of producing the same goods (or an improved one) more quickly and cheaply. But such improvements are not possible without making profits; they can only be paid for if the company earns more than it spends…competition compels each firm to minimize costs and maximize profits. And because the source of all profit is unpaid work, or as Marx prefers, surplus labor, if profits are to rise then labor must be sped up and intensified, its productivity increased” (McNally, Global Slump).

Many capitalists exploit workers and the natural environment without necessarily being avaricious or malevolent. “When capitalists do display greed and other character flaws,” the radical economist Richard Wolff notes, “these flaws are less causes than results of a system that requires certain actions by capitalists who want to survive and prosper” (Richard Wolff, Democracy at Work: A Cure for Capitalism).

The conflict between “hostile [capitalist] brothers” extends beyond production into trade, communications, real estate, insurance, finance and other realms. Great mass retailing firms (Wal-Mart, K-Mart, and Target, for example) battle each other for consumer dollars and market share. Giant media conglomerates duke it out for readers, viewers, listeners, and advertising dollars. Corporate insurance behemoths fight each other for health, life, home, and car insurance sales. Massive financial institutions clash over market shares of home, car, business, and consumer loans and the complex financial securities built on the proliferation of credit.

The So-Called Financial Crisis

These two core and classic tensions of capitalism—(a) the conflict between capitalists and workers over the amount of surplus labor the former can extract from the latter and (b) the conflict between capitalists over how much total surplus value different investor groups get to realize and appropriate—are intimately related to the expansion of the financial sector and its complex financial instruments in the neoliberal era. They are inseparably linked also to the epic economic crisis those instruments and that sector helped create. As Wolff explained as the crisis unfolded in the late summer of 2008, “The so-called financial crisis today is a symptom. The underlying disease is capitalism: an economic system that weaves implacable and destructive conflict into its production and distribution of goods and services.”

These two core and classic tensions of capitalism—(a) the conflict between capitalists and workers over the amount of surplus labor the former can extract from the latter and (b) the conflict between capitalists over how much total surplus value different investor groups get to realize and appropriate—are intimately related to the expansion of the financial sector and its complex financial instruments in the neoliberal era. They are inseparably linked also to the epic economic crisis those instruments and that sector helped create. As Wolff explained as the crisis unfolded in the late summer of 2008, “The so-called financial crisis today is a symptom. The underlying disease is capitalism: an economic system that weaves implacable and destructive conflict into its production and distribution of goods and services.”

During the 1970s, Wolf noted, the U.S. employer class succeeded in slashing U.S. workers wages, making it impossible for the nation’s working class majority to purchase the goods and services produced by an increasingly automated, global, and cheap labor economy. A total crisis of over-production was averted “because U.S. capitalism found a way to postpone it: massive debt.” As Wolff elaborated: “Since employers succeeded in keeping wages from rising, the only way to sell the ever-expanding output was to lend workers the money to buy more. Corporations invested their soaring profits in buying new securities backed by workers’ mortgages, auto loans, and credit-card loans. Owners of such securities were thereby entitled to portions of the monthly payments workers made on those loans. In effect, the extra profits made by keeping workers’ wages down now did double duty for employers who earned hefty interest payments by loaning part of those profits back to the workers. What a system!” (Richard Wolff, “Capitalist Crisis, Marx’s Shadow,” MRZine, September 26, 2008.)

The crisis was only postponed over subsequent decades as a consumer lending boom furthered by financial deregulation “loaded millions of Americans with unsustainable debts. By 2006, the most stressed borrowers—sub- prime—could no longer pay what they owed.” The resulting “house of debt cards” collapsed. Intra-capitalist competition also created the crisis. As Wolff explained: “As some banks made big profits rushing to lend to workers, other lenders feared that those banks would use those profits to outcompete them. So they too rushed into ‘consumer lending.’ To raise the money to make such profitable loans to workers, lenders made expanded use of new types of financial instruments, chiefly securities backed by workers’ debt obligations (securities whose owners received portions of workers’ loan repayments). U.S. lenders sold these securities globally to tap into the entire world’s cash. The whole world thus got drawn into depending on a whirlpool: U.S. capitalism propping up its workers’ purchasing power with costly loans because it no longer raised their wages. The competing rating companies (Fitch, Moody’s, Standard and Poor’s, etc.) inaccurately assessed these securities’ riskiness. These companies competed for the business of lenders who needed high ratings to sell the debt-backed securities. Private and public lenders around the world competed with one another by buying the U.S. debt-backed securities because they were rated as nearly riskless and yet paid high interest rates” (Wolff, “Capitalist Crisis, Marx’s Shadow”).

Foundations of Manufacturing Revival

It is critical to remember, contra Ratigan, that U.S. capitalism never really quit “making” (manufacturing) things. What U.S. corporations and investors really abandoned was making things (manufacturing) inside the U.S. as finance both led and followed a shift of capital to production in lower-wage “developing nations” abroad and particularly in East Asia, especially the giant cheap labor market of China by the 1990s. The shift was driven by capitalism’s endless quest for profit and the surplus labor/value that makes up a critical ingredient of that profit.

If manufacturing revives in the United States to any significant degree in coming years, it will not do so because of any particular commitment on the part of investors to U.S. development. It will happen because U.S. labor, materials, energy, transportation, and/or other production costs have fallen to the point where capitalists find it profitable and competitively advantageous to make things in the so-called homeland.

Consistent with this basic understanding of capital’s aims, it became possible in early 2013 to talk about a mini-revival of U.S.-based manufacturing (R. Foroohar and B. Saporito, “Made in the USA,” Time, April 22, 2013). This was because mass unemployment, the continuing corporate rollback of private sector unions, and the slashing of the welfare state reduced “homeland” wages and benefits to the point where the U.S. became what left analyst Joel Geier calls “the cheap labor market of the advanced industrial world” (J. Geier, “Capitalism’s Long Crisis,” International Socialist Review, March-April 2013). Economist Alan Nasser provides a chilling perspective on how this development creates the basic context for why capital was willing to invest back in U.S. manufacturing to an increased degree: “It is not far-fetched to see a growing resemblance of U.S. and poor-country workers.

“High-priced economic forecasters and consultants are known to refer to the U.S. as ‘Europe’s Mexico.’ In the near future, they predict, some U.S. states, mostly in the South, but also including California and the Rust Belt, will be not only the cheapest manufacturing locations in the developed world, but also competitive with India and China. Wages are rising in the production- and service-oriented poor countries and falling in the rich ones…[since] unrest is brewing in the periphery. Costs of production are gradually converging between China and the U.S.: declining-wage U.S. workers are more productive and fuel prices are expected to continue to rise, making it increasingly expensive to ship goods around the world. Non-union workers contracted by Ford to do inspection and repairs at the Dearborn truck plant make $10 an hour without benefits, which is projected to be less than the Chinese average by 2015…. Companies like Ford, Caterpillar, Wham-O Inc. (Frisbees), Master Lock, Suarez Manufacturing, and General Electric have recently relocated production from China and Mexico to Georgia, Ohio, Indiana, Wisconsin, California, and Michigan. This may or may not be a growing trend, but the mere fact of some U.S. regions becoming newly competitive with Mexico and China bespeaks the declining fortunes of the U.S. worker” (Counterpunch, December 2, 2011).

Along with cheap labor, U.S. industrial competitiveness has recently received a further boost from cheap energy resulting from environmentally disastrous hydraulic fracturing (“fracking”) and horizontal drilling inside the United States. “U.S. oil production grew by 779,000 barrels a day in 2012,” Geier observes, “more in any one year than at any time since the start of U.S. oil production in 1859…. Within a few years, the expectation is that the United States will be the largest world producer of oil…. Oil imports have dropped to a twenty-year low and are now starting to reduce the balance of payments deficit dramatically.” The terrible ecological costs of fracking includes increased carbon emissions and climate warming (currently on the verge of catastrophic levels) and the massive waste and pollution of already endangered North American water supplies. They are of no concern to capital, which never lets worry for the Earth we all share stand in the way of the holy bottom line imperatives of endless accumulation and “growth.”

The Not-So Golden Age

Those who harbor nostalgic feelings for a time when U.S. capitalism was more committed to “making” things inside the U.S. (always on the condition that a profitable level of surplus labor could be extracted from workers) might want to take a closer look at the U.S. experience at its booming “golden age” apex, just prior to the onset of the neoliberal era of corporate globalization, savage U.S. deindustrialization, and related “financiali- zation.” Across the entire postwar period (1945-1971), Howard Zinn noted in 1973, the bottom tenth of the U.S. population—20 million Americans—experienced no progress in increasing their share of national income (a paltry 1 percent). Corporate profits and CEO salaries rose significantly across the 1960s boom, but deep poverty remained deeply entrenched in “the golden age” of western and American capitalism.

As Zinn elaborated: “Being rich or poor was more than a statistic; it profoundly determined how an American lived. In the postwar United States, how much money Americans had determined whether or not they lived in a home with rats or vermin; whether or not their home was such that their children were more likely to die in a fire; whether or not they could get adequate medical and dental care; whether or not they got arrested, and, if they did, whether or not they spent time in jail before trial, whether they got a fair trial, a long or a short sentence, whether or not they got parole. How much money Americans had determined whether or not their children would be born alive. It determined whether or not Americans had a vacation; whether they needed to hold down more than one job; whether or not they had enough to eat; whether or not they could influence a congressman or run for office; whether or not a man was drafted, and what chances a man had that he would die in combat” (Howard Zinn, Postwar America, 1945-1971).

As Zinn elaborated: “Being rich or poor was more than a statistic; it profoundly determined how an American lived. In the postwar United States, how much money Americans had determined whether or not they lived in a home with rats or vermin; whether or not their home was such that their children were more likely to die in a fire; whether or not they could get adequate medical and dental care; whether or not they got arrested, and, if they did, whether or not they spent time in jail before trial, whether they got a fair trial, a long or a short sentence, whether or not they got parole. How much money Americans had determined whether or not their children would be born alive. It determined whether or not Americans had a vacation; whether they needed to hold down more than one job; whether or not they had enough to eat; whether or not they could influence a congressman or run for office; whether or not a man was drafted, and what chances a man had that he would die in combat” (Howard Zinn, Postwar America, 1945-1971).

As the nation spent billions to put astronauts on the moon, millions of Americans remained ill-clad, ill-fed, and ill-housed. The median U.S. family income in 1968 was $8,362, less than what the Bureau of Labor Statistics defined as a “modest but adequate” income for an urban family of four. The Bureau found that 30 percent of the nation’s working class families were living in poverty and another 30 percent were living under highly “austere” conditions. “Affluence,” historian Judith Stein notes, “was as much as an ideology as a description of U.S. society” in the 1950s and 1960s (J. Stein, Pivotal Decade: How the United States Traded Factories for Finance during the 1970s, New Haven, CT, 2010).

U.S. industrial capitalism at its “golden” best was no land of milk and honey for millions of Americans on the wrong end of capital’s constant drive to extract value from working people, the broader community, and the Earth. Thanks to its rapacious and wasteful extraction of wealth from the natural environment, moreover, the profit system had already generated what numerous left and other U.S. environmentalists were already describing as an ecological crisis (see Barry Commoner’s haunting 1971 book The Closing Circle).

We can pine for the past when “the…giant military-industrial complex once dotted the American states with smokestacks and telephone poles as far as the eye could see,” blaming greedy, “vampire”-like finance capitalists—“criminal” manipulators of paper wealth and politicians they own—for tearing it all down. Or, better, we can confront the deeper underlying system and disease called capitalism, a rapacious and extractive exploiter of human beings and the natural environment for more than five centuries now. As Wolff explained two years ago: “Historical and contemporary records overflow with blame variously heaped on the illegal acts of financiers, corporate executives, corrupt state officials, union leaders, and ‘organized crime’ for causing capitalism’s cycles and crises… Pinpointing ‘the bad guys’ perpetuates the ancient art of scape- goating, deflecting blame on convenient targets when in fact the system is the problem. Capitalist societies can continue to monitor, identify, regulate, and prosecute economic misdeeds, but doing so never will prevented cycles and crises. Overcoming the systemic roots and nature of capitalist crises requires a change in the economic system” (Wolff, Democracy at Work).

We might add that saving livable ecology also requires a social and democratic transformation beyond the profits-based economic system, which is no less dependent on rampant, environmentally disastrous waste, excess, and growth in the “financialized” neoliberal era than it was in the years of U.S. mass-productionist manufacturing supremacy. Without such transformation in a generation or two, little else that progressives are concerned about, including the exaggerated wealth and power of finance capital, is going to matter all that much.

Z

Paul Street’s next book is They Rule: the 1% v. Democracy (Paradigm, 2014).

No comments:

Post a Comment