From the Open-Publishing Newswire FROM INDYMEDIA

Related Categories: San Francisco | U.S. | Global Justice and Anti-Capitalism | Labor & Workers

Jail The Bankers, Expropriate Wells Fargo And Make It A Public Bank — Rally In SF

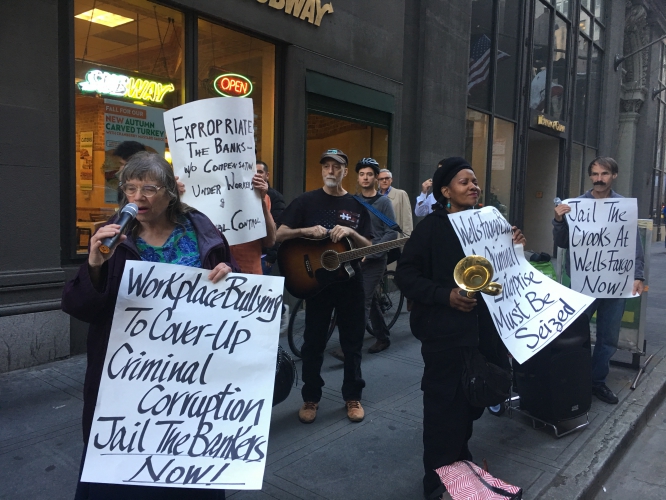

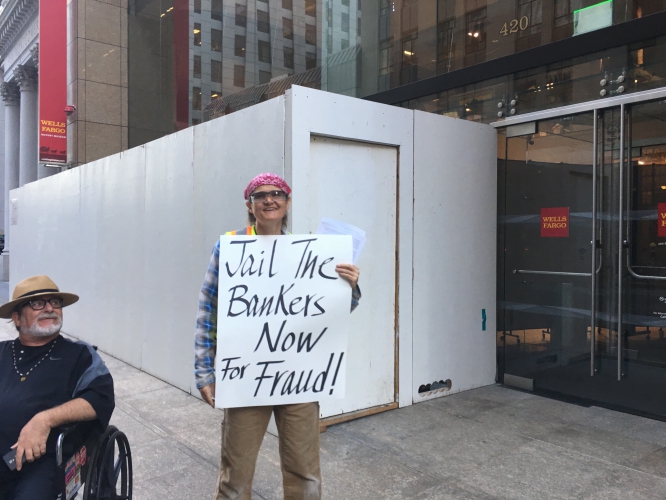

A protest was held at the corporate headquarters of Well Fargo bank in San Francisco on October 26, 2016 calling for the jailing the executives and managers that carried out criminal activity to illegally open 2 million accounts. The rally also called for the expropriation of the bank and for it to become a public bank for working people and the public.

Speakers called for the jailing of Wells Fargo bankers for criminal fraud and for the expropriation of the bank and for it's transformation into a public bank for the people. The Obama administration refuse to press criminal charges despite the illegal opening of 2 million accounts and the illegal setting up of credit card accounts. A statement was also released by fired Federal OSHA Whistleblower Protection Program investigator and lawyer how was prevented from investigating the cases of Wells Fargo workers who had made OSHA complaints. His manager Joshua Paul who was also a lawyer and top officials of OSHA and the Department of Labor including Tom Perez illegally prevented an investigation of systemic corruption of the agency from taking place.

Additional media:

http://www.nbcbayarea.com/news/local/Former-Federal-Investigator-Says-Government-Didnt-Investigate-Wells-Fargo-Whistleblower-Cases-397518261.html

http://www.reuters.com/article/us-wells-fargo-accounts-whistleblower-idUSKCN12D2M0

http://cnnfn.cnn.com/2016/10/18/investing/wells-fargo-warned-fake-accounts-2007/index.html?iid=EL

http://money.cnn.com/2016/09/08/investing/wells-fargo-created-phony-accounts-bank-fees/

https://soundcloud.com/workweek-radio/ww8-9-16-fed-and-state-whistleblowers-ctc-carroll-and-osha-whitman

https://soundcloud.com/workweek-radio/ww8-7-16-osha-wpp-investigator-whitman-on-cover-up-and-corruption

The rally was initiated by United Public Workers For Action

http://www.upwa.info

Production of Labor Video Project

http://www.laborvideo.org

UPWA

UNITED PUBLIC WORKERS FOR ACTION

PRESS RELEASE

Website: http://www.upwa.info

E-mail: info [at] upwa.info

October 26, 2016

We know that Wells Fargo carried out consumer fraud effecting over two million depositors.

And, we know that the fines the regulators demanded of Wells Fargo were only a slap on the wrist.

We also know that John Stumpf (CEO) and Carrie Tolstedt (Senior Executive Vice President of Community Banking!) have walked away with over $250 million in retirement packages even though they were the instigators of the fraud.

Also, over 5000 workers were fired, even though they were forced to carryout illegal acts by Stumpf and Tolstedt.

However, what is the context of this episode and what must be done?

The Wells Fargo episode is integral to the specific stage of capitalism that we have been living in for the past 40 years.

John Bellamy Foster has called that stage Monopoly-Financialization, whereby Wall Street is driving capital accumulation for almost the total benefit of the “One-Percent” at the expense of the “99-Percent” as well as most of the nations of the world.

This situation has been promoted politically since the 1970’s by bi-partisan consensus support from both Democrats and the Republi-cans.

The Great Depression was largely caused by the fact that Wall Street was not regulated, allowing massive speculation during the “Roaring Twenties.” After the Roosevelt Administration passed the 1932 Glass-Steagall Act and the Securities Act of 1933 Wall Street was firmly held in check into the 1970’s. That legislation created an “iron wall” between the commercial and securities banks.

However, beginning in the late-1970’s, the Carter Administration initiated steps to deregulate Wall Street. This was the passage of the 1980 Monetary Control Act, which removed all remaining controls on interests rates and repealed the Federal law prohibiting usury. Since, each administration, regardless of which party was in power, has been in complicity with Wall Street.

The most egregious administration was Bill Clinton’s. This is because in 1999 he signed the Orwellian-sounding Financial Services Modernization Act which repealed Glass-Steagall; therefore completely deregulating the commercial and securities banks.

This allowed the banks and the investor class to pursue hyper-speculation which has directly led to exponential income and wealth inequalities, as well as the 2000 DOT.com Crash and the 2008 Financial Crash.

Nevertheless, rather that putting firm reins on the banks after the 2008 crash the Bush-Obama administration bailed out Wall Street to the tune of $5-7 trillion while also carrying out massive tax cuts, severe austerity policies and rigorous privatization of public services; policies which has devolved much of the country into Third World status. In response to the obvious anger from the public Congress did pass the Dodd-Frank Bill allegedly aimed at re-regulating the banks as well as created the Consumer Finance Protection Bureau.

What has been the result? Dodd-Frank has proven to be as weak as many critics stated prior to its passage; while the Consumer Finance Protection Bureau has had relatively little impact. Also, the Federal Reserve has—through its policy of Quantitative Easing—poured trillions into the coffers of the banks, claiming the intent of creating liquidity. Yet this policy has only fueled speculation, rather than generating living wage jobs for the working class. Furthermore, not one Wall Street executive has been convicted and sent to prison. Not worried about government constraints, Wall Street has gone wild in ripping off the public. This episode, brought to you by Wells Fargo’s is only a drop in the bucket.

All of this has led to a new gigantic bubble which will inevitably burst, sooner rather than later; causing a financial crash that may make 2008 look like a bump in the road.

What must be done?

We know that the ruling class and its managers and politicians will not implement policies to reel in the banks. Nor will either presidential candidate, regardless of who is elected, do anything to reverse austerity and massive tax cuts for the rich, just the opposite.

Believe it or not, once in United States history there was a political party which had a solution that could possibly work today.

In 1892, the recently formed People’s Party—or Populist Party as it is more commonly known called for the banks to be made public as well as the nationalization of the Railroads and public utilities; thus. This would have made the banks accountable to their depositors while serving the needs of workers and local communities, rather than the Robber Barons.

The populist forces were living in the period when the economy was going through a transformation from competitive capitalism to industrial-based monopoly capitalism controlled by corporations and banks. During that process farmers, workers and small business interests were being swallowed up by Wall Street and the Railroads.

In fact, this is what the Preamble of the Populist Party’s 1892 Omaha Platform stated about that:

“We meet in the midst of a nation brought to the verge of moral, political, and material ruin….

“The fruits of toil of millions are boldly stolen to build up colossal fortunes for a few, unprecedented in the history of mankind; and the possessors of these, in turn, despise the Republic and endanger liberty.”

Does that sound familiar?

By 1896, the Populist Party had dissipated into the Democratic Party and much of its platform was coopted into the two-party system–except making the banks, Railroads and utilities public—

during what is known as the Progressive Era (1900-1920).

Today, unlike the late-nineteenth/early twentieth century, there will be no social reform. This is because reform is not in the interest of the ruling class. In fact, the ruling class is no longer committed to national development, only sucking up every bit of existing surplus capital. Moreover, the objective conditions today demand a global transformation not just national reform: the United States economy is just too integrated into the inter-state world capitalist system.

Finally, what we must keep in mind, we are living in the midst of a historically unique “Political Opening” where radical change is possible. But what is necessary is the mobilization of united workers armed with a politically coherent strategy, an inter-nationalist-orientation and transformative vision for the future.

If that could happen, when the financial architecture crashes next time, the prospect for radical change will exist.

It is critical now that all working people not only call for the imprisonment of the criminals who run Wells Fargo but also for it’s seizure and for it to become a public bank run for and by working people.

UPWA was formed in 2008 to united all public workers in the California and the United States and to defend public services and public education. This means fighting privatization, outsourcing and also for public control of the banks, energy industry and utilities. It also supports a democratic mass workers party for to defend all working people and the oppressed in this country.

This is more important than ever.

Federal OHSA WPP Investigator Darrell Whitman Statement On Wells Fargo Bank

JAIL THE BANKERS, FIRE THE REGULATORS, NATIONALIZE THE BIG BANKS!

10/26/16

Statement Regarding Wells Fargo

My name is Darrell Whitman. Beginning in July 2010, I worked as an investigator for OSHA’s Whistleblower Protection Program. OSHA’s Whistleblower Protection Program is the nation’s principle gatekeeper for screening reports of risks to the nation’s safety, health, and financial security. When OSHA investigates and finds “a reason to believe” laws have been broken, it is required to provide the results of its investigation to the Securities and Exchange Commission – SEC, which as the primary bank regulator should then take further action to stop the illegal activity.

I recently have been in conversations with national journalists concerning the scandal regarding Wells Fargo’s massive fraud in the management of its’ customer’s accounts. This is what I know and what I have learned.

1. In 2007, an employee of Wells Fargo reported to the OSHA Wells Fargo was engaging in fraud by creating phony customer accounts and falsely billing customers for services they did not request and costs they did not authorize. OSHA investigated and found a reason to believe fraud was occurring. Whether or not OSHA reported the results of its investigation to the SEC, the SEC didn’t take any action to stop the fraud.

2. In November 2010, as a new OSHA whistleblower investigator, I was directed to close two complaints by Wells Fargo employees without conducting an investigation. OSHA never interviewed the employees, and closed the complaints even though Wells Fargo failed to defend the allegations. The two complaints mirrored the fraud reported earlier in 2007, and closing the complaints meant that OSHA would not report these cases to the SEC.

However, before closing the cases, OSHA provided copies of the complaints to Wells Fargo senior attorney in Los Angeles, showing that once again Wells Fargo senior management was informed about the ongoing customer accounts fraud.

3. In January 2012, I was assigned a third case brought against Wells Fargo that duplicated the reports of the first two cases. The case was quickly transferred to another investigator, and then a third investigator, and as of today – almost five years later, OSHA has failed to do any investigation, including failing to interview the employee.

4. Between 2010 and 2015, OSHA received at least two, and probably many more, complaints from Wells Fargo employees about fraudulent customer account practices. Like the three cases I handled, OSHA never conducted proper investigations, or made reports to the SEC.

5. In early September, the Consumer Financial Protection Bureau fined Wells Fargo $185 million after it determined that Wells Fargo had engaged in fraud as reported to OSHA. This was in addition to a fine of $4 million for defrauding student loan debtors levied in early August. The CFPB concluded senior Wells Fargo managers knew about the accounts fraud in 2013, and possibly earlier. The fines amounted to little more than a tax-deductible parking ticket for the bank, which is the fourth largest bank in the U.S., with assets of some $2 trillion, and which earns billions in profits every year.

6. The banks CEO, John Stumpf, was forced to resign earlier this month, but was allowed to take away $130 million in stock. No other senior manager at Wells Fargo has suffered any adverse consequences, and none of the banks senior managers or executive is now being charged with crimes, even as the bank fired more than 5,000 employees.

7. Three years ago, JP Morgan-Chase, the nation’s largest bank with more than $2.5 trillion in assets – one-fourth of all bank assets in the U.S, had to pay $13 billion to settle a civil lawsuit knowingly selling investments backed by bad residential home loans. While it seems like a huge settlement, but in reality it did little to dent the banks $18 billion a year profits. Nor did it discourage fraudulent practices by the bank in the management of its investment accounts, where it faced a $267 million fine last December for failing to disclose conflicts of interest to customers where the bank was steering them into high-risk investments in which the bank itself had an interest.

The four largest banks in the U.S. control 80% of all bank assets. After years of regulatory neglect and favorable treatment by the federal government, the corporate officers of these banks have come to believe they are beyond accountability. In effect, these banks, as well as many other big banks are nothing more than organized crime on a scale never before seen. If the banks themselves are “too big to fail”, the bank officers are NOT too powerful to jail.

When Iceland five years ago faced a financial crisis generated by its “too big to fail” banks and complicit government officials, the people of Iceland took aggressive action, demanding the government take control of the banks and that the top bankers and Prime Minister be jailed. In spite of the hysterical reaction by the big banks in Europe and the U.S., the big banks were nationalized, the bankers and Prime Minister were jailed, the banks then adopted debt relief for those who had been defrauded, and the Icelandic economy grew, and grew, and grew, until it became the healthiest economy in all the industrialized world.

The U.S is the only advanced economy in the world that doesn’t have a national public bank devoted to serving people and the public interest, rather than a small group of super-wealthy and greedy bankers. As the federal government did with General Motors in 2009, the authority exists to take over Wells Fargo and JP Morgan-Chase under these circumstances and operate them as a public enterprise. As with all crises, the scandals rocking Wells Fargo and JP Morgan-Chase are our opportunity to reform banking and put it to use creating jobs, protecting the environment, and treating employees with dignity and respect.

JAIL THE BANKERS, FIRE THE REGULATORS, NATIONALIZE THE BIG BANKS!

Darrell Whitman

October 26, 2016

publicsafety4america [at] gmail.com

Darrell Whitman is also the AFGE Local 2391delegate to the San Francisco Labor Council SFLC

Additional media:

http://www.nbcbayarea.com/news/local/Former-Federal-Investigator-Says-Government-Didnt-Investigate-Wells-Fargo-Whistleblower-Cases-397518261.html

http://www.reuters.com/article/us-wells-fargo-accounts-whistleblower-idUSKCN12D2M0

http://cnnfn.cnn.com/2016/10/18/investing/wells-fargo-warned-fake-accounts-2007/index.html?iid=EL

http://money.cnn.com/2016/09/08/investing/wells-fargo-created-phony-accounts-bank-fees/

https://soundcloud.com/workweek-radio/ww8-9-16-fed-and-state-whistleblowers-ctc-carroll-and-osha-whitman

https://soundcloud.com/workweek-radio/ww8-7-16-osha-wpp-investigator-whitman-on-cover-up-and-corruption

The rally was initiated by United Public Workers For Action

http://www.upwa.info

Production of Labor Video Project

http://www.laborvideo.org

UPWA

UNITED PUBLIC WORKERS FOR ACTION

PRESS RELEASE

Website: http://www.upwa.info

E-mail: info [at] upwa.info

October 26, 2016

We know that Wells Fargo carried out consumer fraud effecting over two million depositors.

And, we know that the fines the regulators demanded of Wells Fargo were only a slap on the wrist.

We also know that John Stumpf (CEO) and Carrie Tolstedt (Senior Executive Vice President of Community Banking!) have walked away with over $250 million in retirement packages even though they were the instigators of the fraud.

Also, over 5000 workers were fired, even though they were forced to carryout illegal acts by Stumpf and Tolstedt.

However, what is the context of this episode and what must be done?

The Wells Fargo episode is integral to the specific stage of capitalism that we have been living in for the past 40 years.

John Bellamy Foster has called that stage Monopoly-Financialization, whereby Wall Street is driving capital accumulation for almost the total benefit of the “One-Percent” at the expense of the “99-Percent” as well as most of the nations of the world.

This situation has been promoted politically since the 1970’s by bi-partisan consensus support from both Democrats and the Republi-cans.

The Great Depression was largely caused by the fact that Wall Street was not regulated, allowing massive speculation during the “Roaring Twenties.” After the Roosevelt Administration passed the 1932 Glass-Steagall Act and the Securities Act of 1933 Wall Street was firmly held in check into the 1970’s. That legislation created an “iron wall” between the commercial and securities banks.

However, beginning in the late-1970’s, the Carter Administration initiated steps to deregulate Wall Street. This was the passage of the 1980 Monetary Control Act, which removed all remaining controls on interests rates and repealed the Federal law prohibiting usury. Since, each administration, regardless of which party was in power, has been in complicity with Wall Street.

The most egregious administration was Bill Clinton’s. This is because in 1999 he signed the Orwellian-sounding Financial Services Modernization Act which repealed Glass-Steagall; therefore completely deregulating the commercial and securities banks.

This allowed the banks and the investor class to pursue hyper-speculation which has directly led to exponential income and wealth inequalities, as well as the 2000 DOT.com Crash and the 2008 Financial Crash.

Nevertheless, rather that putting firm reins on the banks after the 2008 crash the Bush-Obama administration bailed out Wall Street to the tune of $5-7 trillion while also carrying out massive tax cuts, severe austerity policies and rigorous privatization of public services; policies which has devolved much of the country into Third World status. In response to the obvious anger from the public Congress did pass the Dodd-Frank Bill allegedly aimed at re-regulating the banks as well as created the Consumer Finance Protection Bureau.

What has been the result? Dodd-Frank has proven to be as weak as many critics stated prior to its passage; while the Consumer Finance Protection Bureau has had relatively little impact. Also, the Federal Reserve has—through its policy of Quantitative Easing—poured trillions into the coffers of the banks, claiming the intent of creating liquidity. Yet this policy has only fueled speculation, rather than generating living wage jobs for the working class. Furthermore, not one Wall Street executive has been convicted and sent to prison. Not worried about government constraints, Wall Street has gone wild in ripping off the public. This episode, brought to you by Wells Fargo’s is only a drop in the bucket.

All of this has led to a new gigantic bubble which will inevitably burst, sooner rather than later; causing a financial crash that may make 2008 look like a bump in the road.

What must be done?

We know that the ruling class and its managers and politicians will not implement policies to reel in the banks. Nor will either presidential candidate, regardless of who is elected, do anything to reverse austerity and massive tax cuts for the rich, just the opposite.

Believe it or not, once in United States history there was a political party which had a solution that could possibly work today.

In 1892, the recently formed People’s Party—or Populist Party as it is more commonly known called for the banks to be made public as well as the nationalization of the Railroads and public utilities; thus. This would have made the banks accountable to their depositors while serving the needs of workers and local communities, rather than the Robber Barons.

The populist forces were living in the period when the economy was going through a transformation from competitive capitalism to industrial-based monopoly capitalism controlled by corporations and banks. During that process farmers, workers and small business interests were being swallowed up by Wall Street and the Railroads.

In fact, this is what the Preamble of the Populist Party’s 1892 Omaha Platform stated about that:

“We meet in the midst of a nation brought to the verge of moral, political, and material ruin….

“The fruits of toil of millions are boldly stolen to build up colossal fortunes for a few, unprecedented in the history of mankind; and the possessors of these, in turn, despise the Republic and endanger liberty.”

Does that sound familiar?

By 1896, the Populist Party had dissipated into the Democratic Party and much of its platform was coopted into the two-party system–except making the banks, Railroads and utilities public—

during what is known as the Progressive Era (1900-1920).

Today, unlike the late-nineteenth/early twentieth century, there will be no social reform. This is because reform is not in the interest of the ruling class. In fact, the ruling class is no longer committed to national development, only sucking up every bit of existing surplus capital. Moreover, the objective conditions today demand a global transformation not just national reform: the United States economy is just too integrated into the inter-state world capitalist system.

Finally, what we must keep in mind, we are living in the midst of a historically unique “Political Opening” where radical change is possible. But what is necessary is the mobilization of united workers armed with a politically coherent strategy, an inter-nationalist-orientation and transformative vision for the future.

If that could happen, when the financial architecture crashes next time, the prospect for radical change will exist.

It is critical now that all working people not only call for the imprisonment of the criminals who run Wells Fargo but also for it’s seizure and for it to become a public bank run for and by working people.

UPWA was formed in 2008 to united all public workers in the California and the United States and to defend public services and public education. This means fighting privatization, outsourcing and also for public control of the banks, energy industry and utilities. It also supports a democratic mass workers party for to defend all working people and the oppressed in this country.

This is more important than ever.

Federal OHSA WPP Investigator Darrell Whitman Statement On Wells Fargo Bank

JAIL THE BANKERS, FIRE THE REGULATORS, NATIONALIZE THE BIG BANKS!

10/26/16

Statement Regarding Wells Fargo

My name is Darrell Whitman. Beginning in July 2010, I worked as an investigator for OSHA’s Whistleblower Protection Program. OSHA’s Whistleblower Protection Program is the nation’s principle gatekeeper for screening reports of risks to the nation’s safety, health, and financial security. When OSHA investigates and finds “a reason to believe” laws have been broken, it is required to provide the results of its investigation to the Securities and Exchange Commission – SEC, which as the primary bank regulator should then take further action to stop the illegal activity.

I recently have been in conversations with national journalists concerning the scandal regarding Wells Fargo’s massive fraud in the management of its’ customer’s accounts. This is what I know and what I have learned.

1. In 2007, an employee of Wells Fargo reported to the OSHA Wells Fargo was engaging in fraud by creating phony customer accounts and falsely billing customers for services they did not request and costs they did not authorize. OSHA investigated and found a reason to believe fraud was occurring. Whether or not OSHA reported the results of its investigation to the SEC, the SEC didn’t take any action to stop the fraud.

2. In November 2010, as a new OSHA whistleblower investigator, I was directed to close two complaints by Wells Fargo employees without conducting an investigation. OSHA never interviewed the employees, and closed the complaints even though Wells Fargo failed to defend the allegations. The two complaints mirrored the fraud reported earlier in 2007, and closing the complaints meant that OSHA would not report these cases to the SEC.

However, before closing the cases, OSHA provided copies of the complaints to Wells Fargo senior attorney in Los Angeles, showing that once again Wells Fargo senior management was informed about the ongoing customer accounts fraud.

3. In January 2012, I was assigned a third case brought against Wells Fargo that duplicated the reports of the first two cases. The case was quickly transferred to another investigator, and then a third investigator, and as of today – almost five years later, OSHA has failed to do any investigation, including failing to interview the employee.

4. Between 2010 and 2015, OSHA received at least two, and probably many more, complaints from Wells Fargo employees about fraudulent customer account practices. Like the three cases I handled, OSHA never conducted proper investigations, or made reports to the SEC.

5. In early September, the Consumer Financial Protection Bureau fined Wells Fargo $185 million after it determined that Wells Fargo had engaged in fraud as reported to OSHA. This was in addition to a fine of $4 million for defrauding student loan debtors levied in early August. The CFPB concluded senior Wells Fargo managers knew about the accounts fraud in 2013, and possibly earlier. The fines amounted to little more than a tax-deductible parking ticket for the bank, which is the fourth largest bank in the U.S., with assets of some $2 trillion, and which earns billions in profits every year.

6. The banks CEO, John Stumpf, was forced to resign earlier this month, but was allowed to take away $130 million in stock. No other senior manager at Wells Fargo has suffered any adverse consequences, and none of the banks senior managers or executive is now being charged with crimes, even as the bank fired more than 5,000 employees.

7. Three years ago, JP Morgan-Chase, the nation’s largest bank with more than $2.5 trillion in assets – one-fourth of all bank assets in the U.S, had to pay $13 billion to settle a civil lawsuit knowingly selling investments backed by bad residential home loans. While it seems like a huge settlement, but in reality it did little to dent the banks $18 billion a year profits. Nor did it discourage fraudulent practices by the bank in the management of its investment accounts, where it faced a $267 million fine last December for failing to disclose conflicts of interest to customers where the bank was steering them into high-risk investments in which the bank itself had an interest.

The four largest banks in the U.S. control 80% of all bank assets. After years of regulatory neglect and favorable treatment by the federal government, the corporate officers of these banks have come to believe they are beyond accountability. In effect, these banks, as well as many other big banks are nothing more than organized crime on a scale never before seen. If the banks themselves are “too big to fail”, the bank officers are NOT too powerful to jail.

When Iceland five years ago faced a financial crisis generated by its “too big to fail” banks and complicit government officials, the people of Iceland took aggressive action, demanding the government take control of the banks and that the top bankers and Prime Minister be jailed. In spite of the hysterical reaction by the big banks in Europe and the U.S., the big banks were nationalized, the bankers and Prime Minister were jailed, the banks then adopted debt relief for those who had been defrauded, and the Icelandic economy grew, and grew, and grew, until it became the healthiest economy in all the industrialized world.

The U.S is the only advanced economy in the world that doesn’t have a national public bank devoted to serving people and the public interest, rather than a small group of super-wealthy and greedy bankers. As the federal government did with General Motors in 2009, the authority exists to take over Wells Fargo and JP Morgan-Chase under these circumstances and operate them as a public enterprise. As with all crises, the scandals rocking Wells Fargo and JP Morgan-Chase are our opportunity to reform banking and put it to use creating jobs, protecting the environment, and treating employees with dignity and respect.

JAIL THE BANKERS, FIRE THE REGULATORS, NATIONALIZE THE BIG BANKS!

Darrell Whitman

October 26, 2016

publicsafety4america [at] gmail.com

Darrell Whitman is also the AFGE Local 2391delegate to the San Francisco Labor Council SFLC

APWU retired member Alice Lindstrom called for Wells Fargo to become a public bank run for the public and not the profiteers.

There was much support for jailing the bankers at Wells Fargo. Millions of American workers and homeowners have been cheated and robbed by the Wells Fargo executives and the Obama administration let the CEO leave with $130 million

While robbing the customers of hundreds of millions of dollars the Wells Fargo executive and bosses were bullying thousands of workers to commit criminal fraud in opening up illegal accounts and credit cards for customers who did not ask for them.

No comments:

Post a Comment